What will it cost to save Washington, D.C.’s renters from COVID-19 eviction?

This post originally appeared on Brookings.edu on July 23, 2020.

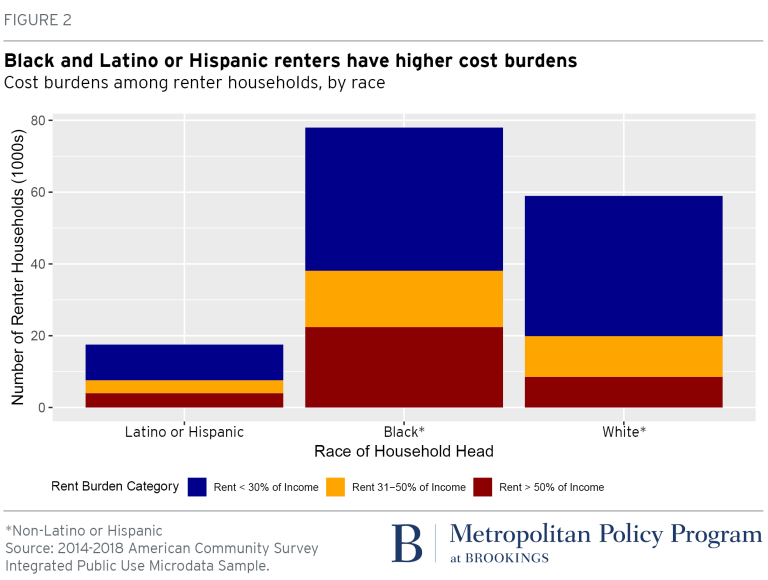

The COVID-19 pandemic and subsequent recession have caused considerable economic stress for the residents of Washington, D.C. Nearly 35% of District households reported some loss of employment income in June, according to the Census Bureau’s Household Pulse Survey—lower than the national average, but still substantial. Black and Latino or Hispanic workers have been hit hardest , both by disproportionate job losses and rates of infection. Low-income, Black, and Latino or Hispanic households are more likely to rent their homes , and had accumulated very little savings before the crisis, making them especially vulnerable to a disruption in employment.

Like renters nationwide , many of Washington, D.C.’s low-income renters likely will be unable to pay their rent in the coming months, especially after federal increases in unemployment benefits lapse after July 31. Widespread defaults on rents could lead to an unprecedented volume of evictions and increases in the number of unhoused people in the District, further increasing public health risks.

So far, it is unclear whether the federal government intends to provide another round of financial assistance to households, or any fiscal support to state and local governments . With that in mind, local policymakers should assess the feasibility of increasing temporary rental assistance to keep low-income renters from losing their homes.

In this piece, we examine housing insecurity among District renters before the pandemic in order to estimate the possible demand for temporary rental assistance. How many renters were stretching to afford housing? How did cost burdens vary by income, race, and household type? Which neighborhoods had the highest concentration of cost-burdened low-income renters? We use these analyses to develop rough estimates for how much would it cost for Washington, D.C.’s local government to provide short-term rental assistance.

LOW-INCOME, BLACK, AND LATINO OR HISPANIC RENTERS FACE THE HIGHEST COST BURDENS

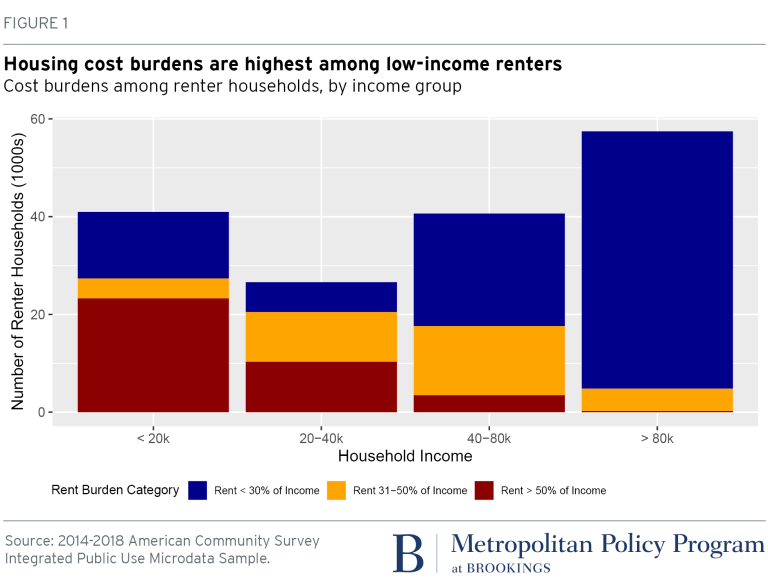

Washington, D.C. is a majority-renter city. Nearly 60% of the District’s approximately 280,000 households rented their homes in 2018, according to American Community Survey data . Nearly one in four renter households spent more than 50% of income on rent, and another 20% spent between 31% and 50% of income on rent—well above the U.S. Department of Housing and Urban Development’s recommended 30% threshold .

Of the lowest-income renters (those earning less than ,000 a year), almost 60% are severely cost-burdened, spending over half their income on rent. For another third of this group, rent consumes 31% to 50% of income. Nearly 40% of renters earning ,000 to ,000 are severely cost-burdened. Severely cost-burdened renters earning less than ,000 collectively account for 20% of the District’s renter households, and are the most vulnerable to income disruptions.

Black households are the largest group of renters in the District, and are most likely to face housing cost burdens. Nearly 30% of Black renters (more than 20,000 households) spend over half their income on rent. Another 20% spend between 31% and 50% of income on rent. Nearly half of Latino or Hispanic renters have housing cost burdens, compared to about one-third of non-Latino or Hispanic white renters.

FAMILIES WITH CHILDREN AND OLDER ADULTS FACE HIGHER HOUSING COST BURDENS

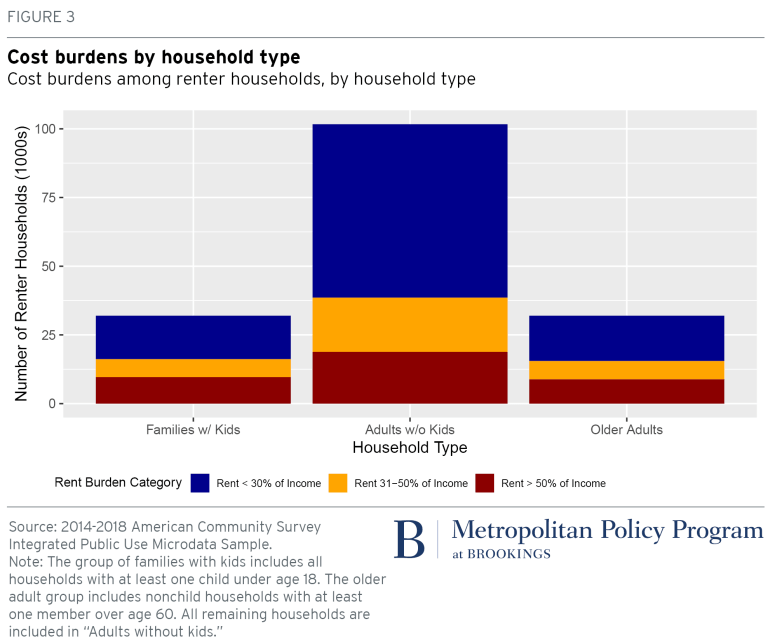

When households experience housing insecurity, their ability to participate in work, go to school, and maintain their health are all impacted. Understanding what kinds of households are at higher risk for displacement helps District policymakers plan for broader support systems, including possible impacts on public schools, the Department of Aging and Community Living, and the Department of Health. In the worst-case scenario, the District maintains separate shelters for unhoused families and homeless adults.

Families with children and older adults are more likely to be severely cost-burdened (nearly 30% of each group) than nonelderly adults without children (20%). However, because adults without children are by far the largest group of renter households in the District, half of all severely cost-burdened renters are in this category. This suggests that households of all types may be vulnerable to displacement due to the pandemic.

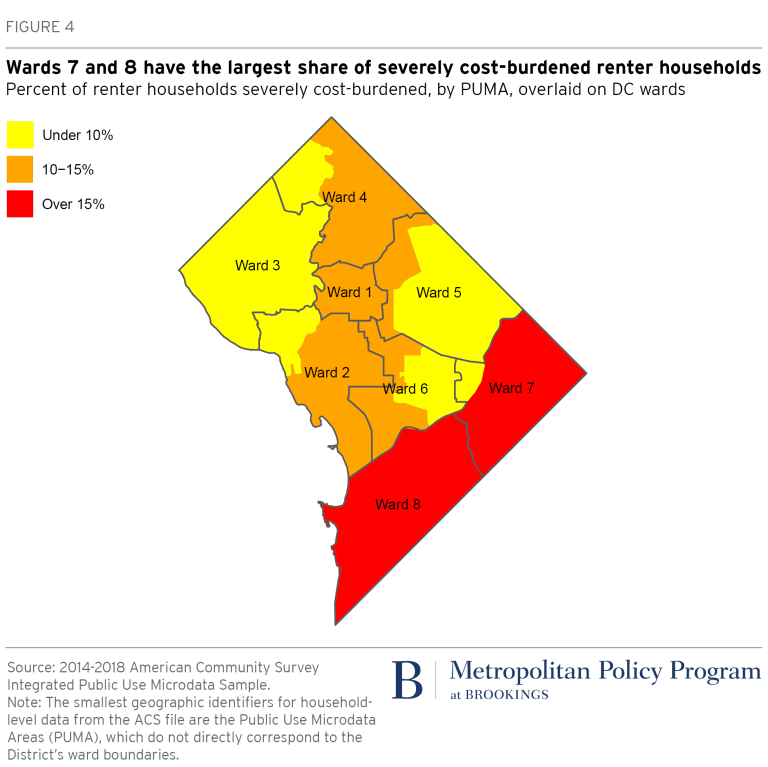

COST-BURDENED RENTERS ARE CONCENTRATED IN SPECIFIC NEIGHBORHOODS

The foreclosure crisis of 2007 to 2009 illustrated the social and economic costs associated with spatially concentrated housing insecurity . Homes that underwent foreclosure caused property values of nearby homes to decline, leading to additional foreclosures , vacancies, and blight in surrounding neighborhoods. While there is not equivalent research on the community impacts of spatially concentrated evictions, it is likely that large-scale displacement of families within certain neighborhoods will create greater demand for social services and philanthropic support in those parts of the District. Mapping the rates of severely cost-burdened renters in Washington, D.C. shows that Wards 7 and 8 have the highest concentrations of housing-insecure renters, with the lowest concentrations in Wards 3 and 5.

HOW MUCH WOULD IT COST TO HELP COST-BURDENED RENTERS STAY AFLOAT?

Policymakers around the country are debating how best to support households and communities during the economic shutdown. One challenge to allocating funding for rental assistance is the high degree of uncertainty: How many households are unable to pay their rent, and for how long?

To develop rough cost estimates, we combine two Census Bureau data sets. In addition to the ACS-IPUMS data presented so far, we draw on the Household Pulse Survey, which provides weekly updates on how many renters report not paying their current month’s rent, and their confidence at being able to make the next month’s payment.

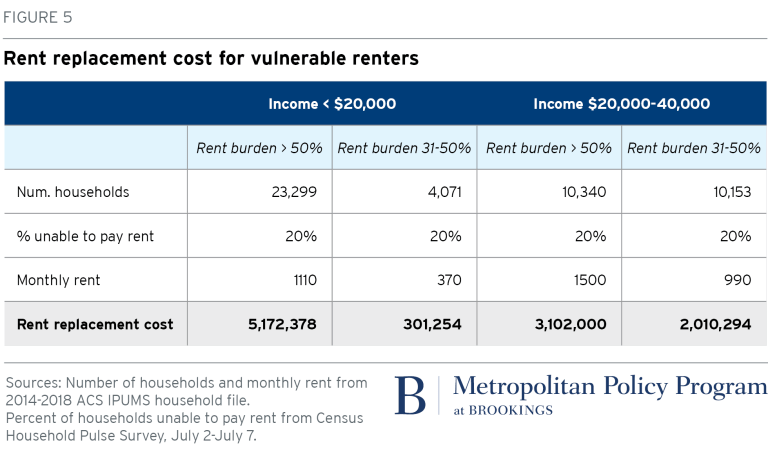

In the most recent release, corresponding to the week of July 2 to July 7, 20% of renter households in the District said they had no or slight confidence that they would be able to pay their rent next month. We multiplied this percentage by the number of cost-burdened renters and the median monthly rent for each renter group in order to estimate the amount of replacement rent needed.

Under these assumptions, it would cost nearly .2 million to cover one month of rent for the group of renters most likely to experience displacement (or assuming that eligibility for rental assistance was set based on a pre-pandemic income of ,000). For context, the District’s Fiscal Year 2021 draft budget currently allocates about million for the Emergency Rental Assistance Program over the next year—equivalent to about three months of replacement rent. The District’s 2020 budget included about 0 million for a range of housing and homelessness-prevention programs.

Expanding rental assistance to cover households with pre-pandemic income up to ,000 would increase the budget considerably. Analysts can make a range of credible assumptions for any of the inputs into these estimates; this is intended only as a starting point.

URGENT NEED, BUT NO EASY OPTIONS

The COVID-19 pandemic has already created unprecedented economic distress in the District and across the country. Low-income households had little financial cushion before the crisis; finding the resources to pay for rent, food, and other necessities after several months of reduced economic activity is nearly impossible for many. The prospect of widespread evictions threatens the health and safety of households and communities.

State and local policymakers around the country are caught between shrinking revenues and increased demand for public services—a dilemma without good options. Only the federal government has the financial and institutional capacity to support households and communities during a prolonged recession, yet the prospects for another round of federal stimulus are uncertain . If Congress does not ride to the rescue soon, it will be up to local policymakers like those in the District to decide what they are able and willing to do for their most vulnerable residents.