McCourt Student Launched Free Tax Prep Service Led by D.C. High School Students

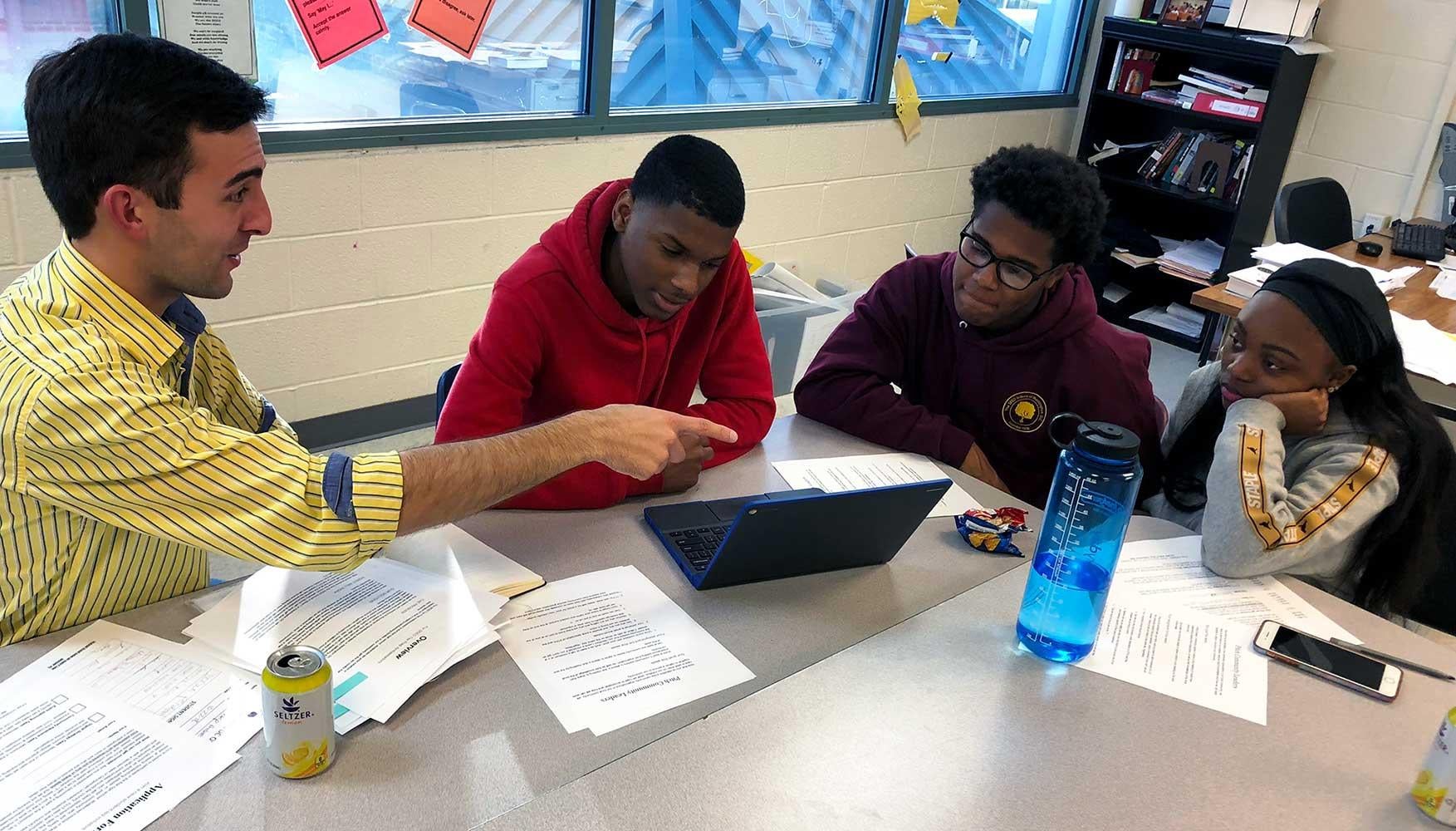

Seeing an opportunity to help D.C. taxpayers, Peter Nouhan (MPP ’19) founded a program to train Washington, D.C., high school students to facilitate free tax preparation for low- and middle-income workers, many of whom miss out on thousands of dollars in unclaimed tax credits every year.

Thanks to a grant from the Baker Center for Leadership & Governance (now known as the Baker Trust for Transformational Learning) as well as the help of several community partners, SEED Tax Prep Ambassadors launched last year and returned 0,000 to 90 D.C. residents. The program also provided leadership experience to six high school students at SEED Public Charter School of Washington, D.C., by training them to coordinate the tax preparation process at a volunteer-run prep center in Southeast D.C.

“The goal of this project was to deliver free tax preparation services in an area of Washington, D.C., that is more difficult to reach in terms of getting volunteers into the community to serve people who need this assistance the most,” says Nouhan, who also partnered with Community Tax Aid D.C., a volunteer-based tax preparation service that has been serving low-income residents in the District for more than 30 years.

Creating a ‘Measurable Impact’

Almost 20,000 eligible taxpayers in D.C. do not claim the Earned Income Tax Credit—a refundable tax credit for low- to middle-income workers—according to

Capital Area Asset Builders. This amounts to millions of dollars in lost benefits that could be going to those most in need.

To help close this gap, SEED Tax Prep Ambassadors piloted a drop-off tax prep model that allowed clients to drop off their tax materials at a dedicated prep center, which was located at St. Luke’s Catholic Church. SEED D.C. students then worked with clients one-on-one to ensure they had all the required paperwork before sending the materials electronically to professional preparers to complete the filing process remotely.

Nouhan also brought in Georgetown University undergraduates and members of the student-run tax assistance program, Hoya Taxa, as an additional partner to help mentor the high school students and teach them about the tax filing system.

At final count, SEED Tax Prep Ambassadors saved individual clients an average of 0 just for doing the service for free, and it was able to provide an average return of more than ,239 to individual taxpayers.

“We had a huge measurable impact, and we’re hoping to continue this project again for another year,” says Nouhan, who is also hoping to secure funding to pilot a completely virtual tax prep model that would provide clients with same-day tax preparation by allowing them to meet remotely with a professional preparer.

Long term, Nouhan would also like to find additional partners to help support the project and create a sustainable model of leadership that would ensure the program’s continued success and potential growth.

“We want to create an example that this can be done not just in one community but in multiple communities,” says Nouhan, who wants to expand the program as an extracurricular activity to other high schools in the District as well as Maryland and Virginia. “Until the tax system works better for working low- and middle-income people, I think there’s a role here for young people and aspiring leaders to be more involved in their communities in delivering a service like this to people in need.”